Getfreedomunlimited.com – If you receive Chase Freedom Unlimited card invitation then congratulations, because you are eligible to get a new Chase Freedom Unlimited credit card only at www.Getfreedomunlimited.com. Chase Freedom Unlimited card is one of the best credit card right now in 2024. There is no annual fee.

There are many credit cards out there but the chase freedom unlimited has got to be the best most complete off-purpose credit card around in my opinion. not only this it offer great rewards benefits a nice welcome bonus and more but it’s a credit card that anyone can find value in due to all that offers so.

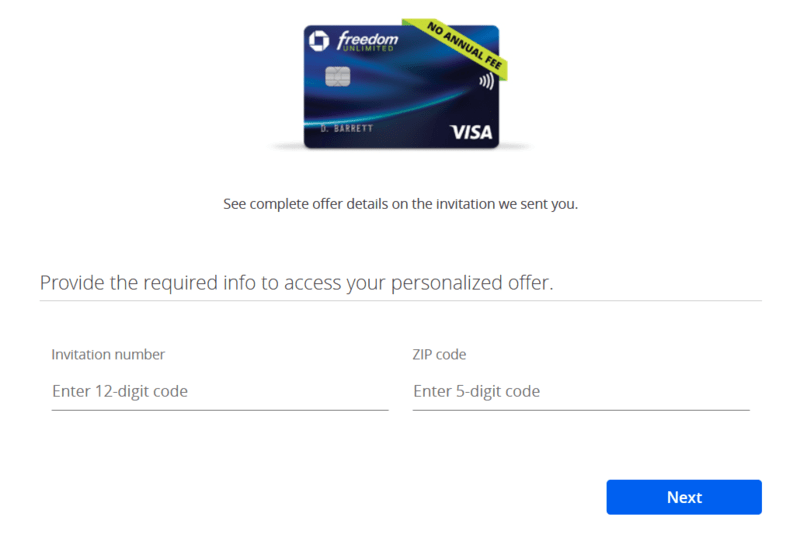

How To Apply Chase Freedom Unlimited Credit Card at Getfreedomunlimited.com?

- First you may visit http://www.Getfreedomunlimited.com.

- Now enter your 12 digit Chase Freedom Unlimited credit card invitation number that you received in your email.

- Enter your zip code and click on the Next button.

Chase Freedom Unlimited Card Cash Back Rewards & Benefits

$200 bonus plus 5% gas station cash back offer

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.* Same page link to Offer Details And earn 5% cash back on gas station purchases on up to $6,000 spent in the first year.* Same page link to Offer Details

This product is available to you if you do not have this card and have not received a new card member bonus for this card in the past 24 months.

Earn cash back

- Earn 5% on travel purchased through Chase Ultimate Rewards.* Same page link to Offer Details

- Earn 3% on dining at restaurants, including takeout and eligible delivery services.* Same page link to Offer Details

- Earn 3% on drugstore purchases.* Same page link to Offer Details

- Earn 1.5% on all other purchases.* Same page link to Offer Details

Low intro APR

0% intro APR for 15 months from account opening on purchases and balance transfers.† Same page link to Pricing and Terms After the intro period, a variable APR of 17.24%–25.99%.† Same page link to Pricing and Terms Balance transfer fee applies, see pricing and terms for more details.

No annual fee

You won’t have to pay an annual fee† Same page link to Pricing and Terms for all the great features that come with your Freedom Unlimited card.

Cash Back rewards do not expire

Cash Back rewards do not expire as long as your account is open.* Same page link to Offer Details And there is no minimum to redeem for cash back.

What is Chase Freedom Unlimited Card

In this post i am going to discuss about this amazing credit card because i have it myself and love it plus new rewards have recently been added to this card that i truly believe a lot of you can find tremendous value from so to begin with this credit card is currently offering a signup bonus of $200 after you spend $500 on purchases within the first three months of opening your account this means that if you spend $167 dollars per month you’ll easily hit that $500 spending limit and get yourself a free two hundred dollars so if you’re going to spend money anyways you might as well put it on this credit card and earn yourself a big bonus now in addition to that you’ll also get zero percent intro apr for 15 months on purchases and balance transfers.

So if you need to make a big purchase or balance transfer you can easily do so with this credit card and pay no interest for up to 15 months now if you decide to take advantage of this bonus on purchases just please remember that carrying a big balance on a credit card will increase your credit utilization which can in return affect your credit score negatively so although they give you 15 months of no interest on purchases make sure that you’re able to pay that balance off in full as soon as possible that way your credit utilization on the card remains slow and your credit score doesn’t take a huge hit moving forward this card currently also offers 5% percent cash back on gas station purchases and up to six thousand dollars spent in the first year of you having this credit card that’s a potential value of three hundred dollars back on gas alone. and i mean with gas prices being as high as they currently are this can be of huge value to a lot of people on top of that.

Cash Back Rewards Points

You can earn other rewards such as five percent on travel purchase to chase ultimate rewards including flights hotels car rentals activities and cruises three percent on dining at restaurants including takeout and eligible deliveries three percent on drugstore purchases and lastly 1.5% on all other purchases now the rewards you earn with this credit card will come in the form of points which you’ll then be able to redeem towards cash back gift cards travel pay yourself back dining pay with points or you can transfer or combine your points with a higher tier chase card such as the sapphire preferred or reserve card and get even more value out of your points speaking of points the way you choose to redeem your points will ultimately determine the final value you get from them so as you can see on the screen you got all the different redemption options we just went over and their point value so when choosing how to redeem your points you can simply take a look at this charm or if you apply for this credit card at www.Getfreedomunlimited.com you can check your points value easily on the chase portal that should give you the most accurate value plus an idea of what redemption option to choose in order to get the most value back from your points.

How To Redeem Chase Freedom Unlimited Credit Card Rewards Points

Now the best and most notorious way to redeem your points for the most value back will be by transferring your points to high tier chase cards such as the sapphire reserve or the preferred card towards travel as mentioned earlier what happens when you transfer your points to these cards is that your points will automatically be worth way more when you redeem them for travel through the chase portal that’s because with the chase freedom unlimited your points are only worth 1 cent per point when redeemed towards travel while with the sapphire preferred card your points are worth 1.25 cents per point and with the sapphire reserve card your points are worth 1.5 cents per point so to give you a visual 10000 points on the chase freedom unlimited when redeemed towards travel is the same as a hundred dollars but those same 10000 points transferred to the sapphire preferred will have a value of $125 dollars and if transferred to the sapphire reserve those points will have a value of 150 dollars which is ridiculously awesome so again the way you choose to redeem your chase points will ultimately determine your points value now.

- Chase Freedom Unlimited Card – 1 Point = 1 cent (10000 = $100)

- Sapphire Preferred Card – 1 Point = 1.25 cent (10000 = $125)

- Sapphire Reserve Card – 1 Point = 1.5 cent (10000 = $150)

But my favorite part about this card is that it has no annual fee so you get to enjoy all the rewards and benefits that this credit card offers completely for free plus this card has no foreign transaction fees your earn points do not expire as long as your account is open and there is no minimum on how much cashback you can earn with this card or redemption requirement i mean it’s not called the freedom unlimited for nothing anyways in addition to those amazing perks this card comes packed with additional rewards and benefits such as offers from a variety of categories and popular places such as amazon fresh chevron cvs fubotv chipotle and the list goes on plus it comes packed with a bunch of useful protection benefits such as zero liability protection purchase protection extended warranty trip cancellation and interruption insurance 24/7 fraud protection and alerts auto rental collision damage waiver travel and emergency assistance services and a lot more so now that we went over everything that this credit card offers let’s dive into how much value you can get from this credit card on just your first year now as mentioned in the beginning of this video this card is currently offering a two hundred dollar welcome bonus in addition to that you’ll earn 5% on gas station purchases and up to $6,000 spent in the 1st year of you having this card that’s a total potential value of dollars if you hit that six thousand dollar spending limit on your first year with this card.

You’ll also earn five percent on travel purchased through chase ultimate rewards including flights hotels car rentals activities and cruises now the average baby boomer as mentioned in my previous post and based on the article shown on the screen spends about sixty six hundred dollars on travel per year so using this number for our example times five percent gives you a total value of three hundred and thirty dollars you’ll also earn three percent on dining at restaurants including takeout and eligible deliveries now according to this other article on the screen the average American spends thirty five hundred dollars eating out yearly so thirty five hundred dollars times three percent gives you a total value of a hundred and five dollars on top of that you’ll earn three percent on drug store purchases so assuming that you spend about one thousand dollars per year in this category that’s a total value of thirty dollars and lastly you’ll earn one point five percent on all other purchases now yearly i spend a little over $20k on all other purchases so let’s go ahead and use this number for our example anyways 20k times 1.5 percent gives you a total value of $300 so when you add everything up you’re looking at a total value of $1265 dollars if that’s not impressive for a no annual fee credit card then i don’t know what is my friends but the craziest part about it all is that your value can increase depending on how you choose to redeem your points like we mentioned earlier for example if we were to transfer our total value which is the same as $126. Then 500 chase points to the chase sapphire reserve that offers 1.5% point on travel those same points could be worth 1879 towards travel which is an extra value of $614 dollars but for those who don’t travel much and would simply just like to redeem towards cash back or any other redemption option you’re still looking at a bunch of money back per year with this card having said that though please keep in mind that these are just example numbers and your value could be higher or lower depending on your own spending habits.

So at the end of the day the question is should you get the chase freedom unlimited well in my opinion if you spend a lot on travel dining and drugstores than this card is a no-brainer because it offers great rewards in those categories it also offers a pretty high reward rate on all other purchases which makes this card a great credit card to have in your wallet for all other purchases i mean earning 1.5 back on everything you buy is simply amazing so honestly i don’t have a single bad thing to say about this card i mean i have had it for over two years and it’s one of my favorite and most recommended credit card i tell people to get just because it’s loaded with great rewards and benefits and it also has no annual fee but as i always say when choosing a credit card to apply for you need to make sure that your spending habits align to what the credit card offers or vice versa in order for you to be able to benefit and get the most value back out of the credit card in the case of the chase freedom unlimited if you don’t find yourself spending as much money in their top earning categories which are travel dining and drugstore purchases then the most you’ll be able to benefit from is that 1.5 on all other purchases so in this case you might be better off getting a different credit card that fits your spending habits a little better anyways peeps that’s gonna be the end of today’s video for those interested in signing up for this awesome credit card and getting yourself a free two hundred dollars plus three hundred dollars back on gas on your first year with this credit card and more feel free to sign up for it using my link down in the description or in the comment section also comment down below what you think about the chase freedom unlimited if you have it like it plan on getting it or if you think there are better comparable cards out there having said that that’s going to be the end of today’s video i really hope you guys enjoyed this video if you did please hug the like button subscribe turn on those post notifications that way you never miss out on any future uploads and i’ll catch you guys on the next one

unsubscribe from all offers

david booth is dead

invitation 7880 7807 3640

offer MZ5

Is this offer for the Chase Freedom Unlimited offer good for existing Chase cardholders? Thanks